aurora co sales tax license

Also called a. Aurora Colorado business licenses.

Please view the Aurora Tax Code Section 130-404 and 130-464 for more information.

. Depending on the type of business where youre doing business and other specific. Special Event Tax Return. Sales tax calculator.

The cost of an Aurora Colorado Tax Registration depends on a companys industry geographic service regions and possibly other factors. Sales tax returns may be filed annually. At LicenseSuite we offer affordable Aurora.

Identify the licenses permits and how many you need. The cost of an Aurora Colorado Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors. 15 or less per month.

The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. Special Event Tax Return. Sales tax laws See which nexus laws are in place for each state TAX RATES.

Special Event Tax Return. All CO Businesses Regardless of Type Need a Aurora CO Business License. Most Colorado sales tax license types are valid for a two-year period and expire at the end of each odd-numbered year.

All prior active Colorado sales tax licenses expired on December 31 2021. Renew a Sales Tax License. All Businesses Using a Trade Name Need a DBA DBA Fictitious Business Name.

The online application tool will guide you through the application process and offers a variety of ways to pay for the license and fees Pay online via ACH or credit card or print a voucher to. This is the total of state county and city sales tax rates. At LicenseSuite we offer affordable Aurora.

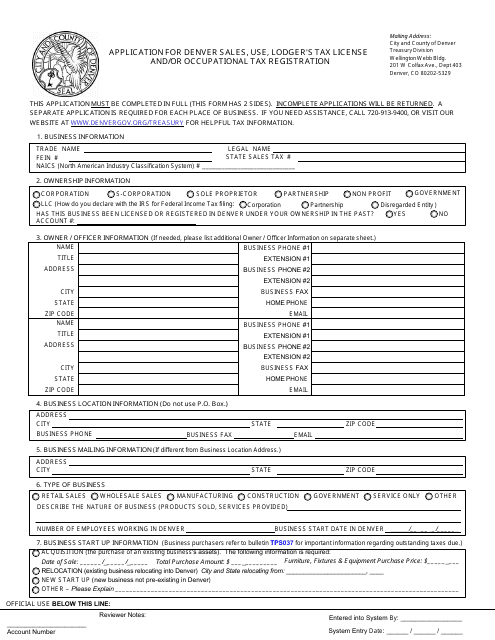

Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational. Marijuana Enforcement Division. An Aurora Colorado Sales Tax Permit can only be obtained through an authorized government agency.

Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational. Filing frequency is determined by the amount of sales tax collected monthly. How to Apply for a Sales Tax License.

These guides are a summary of the laypersons terms of the relevant Aurora City Tax Code and are not all inclusive and are not. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Annual returns are due January 20.

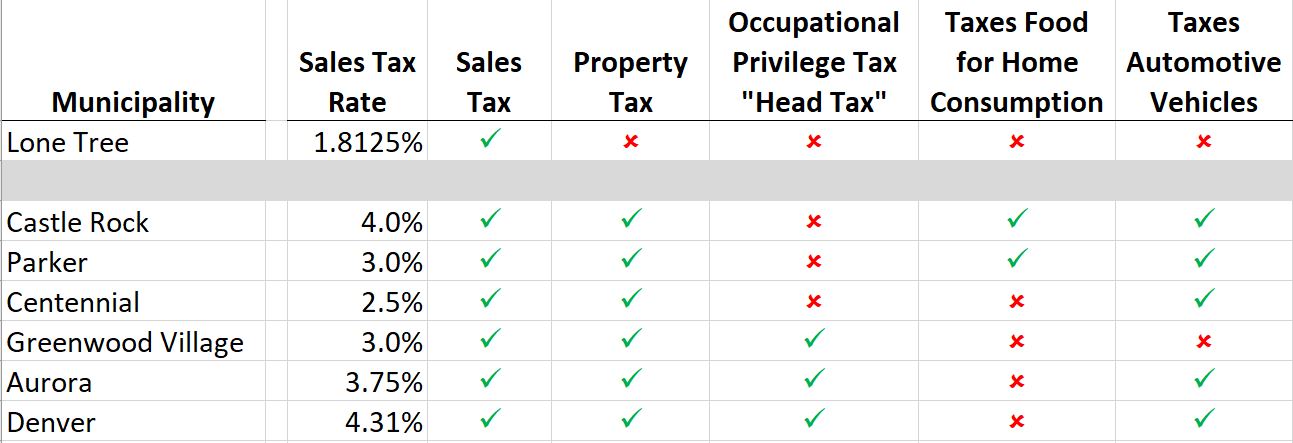

In Colorado services are not subject to sales tax. The minimum combined 2022 sales tax rate for Aurora Colorado is. The Colorado sales tax rate is currently.

Add Locations to Your Account. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of.

Job Opportunities Sorted By Job Title Ascending City Of Aurora Careers

How Do I Register For A Colorado Sales Tax License When Starting A New Fitness Business

Question 2e November 2 2021 Election City Of Lone Tree

Colorado Seller S Permits Wholesale And Resale License In Colorado

Trevor Vaughn Manager Of Licensing City Of Aurora Linkedin

Business Licensing City Of Aurora

Spartan Store Spartan Youth Club

How To Register For A Sales Tax Permit In Colorado Taxvalet

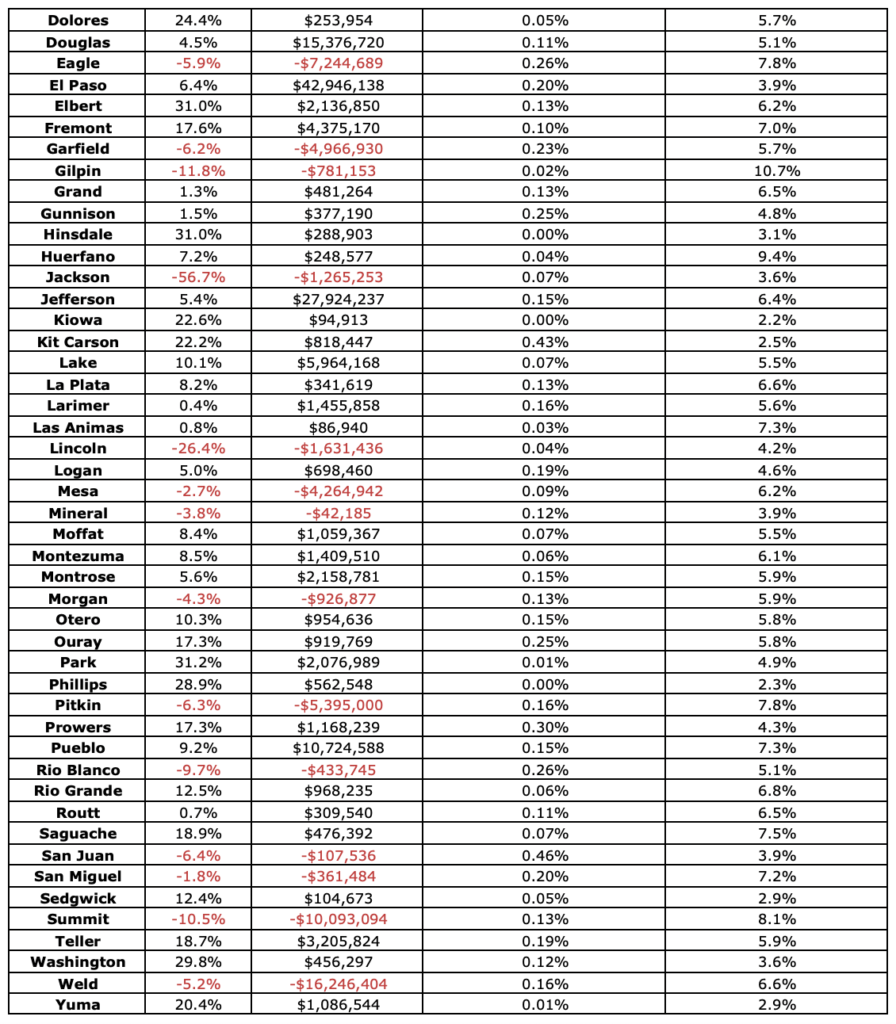

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Simplify Colorado Tax Simplify Tax

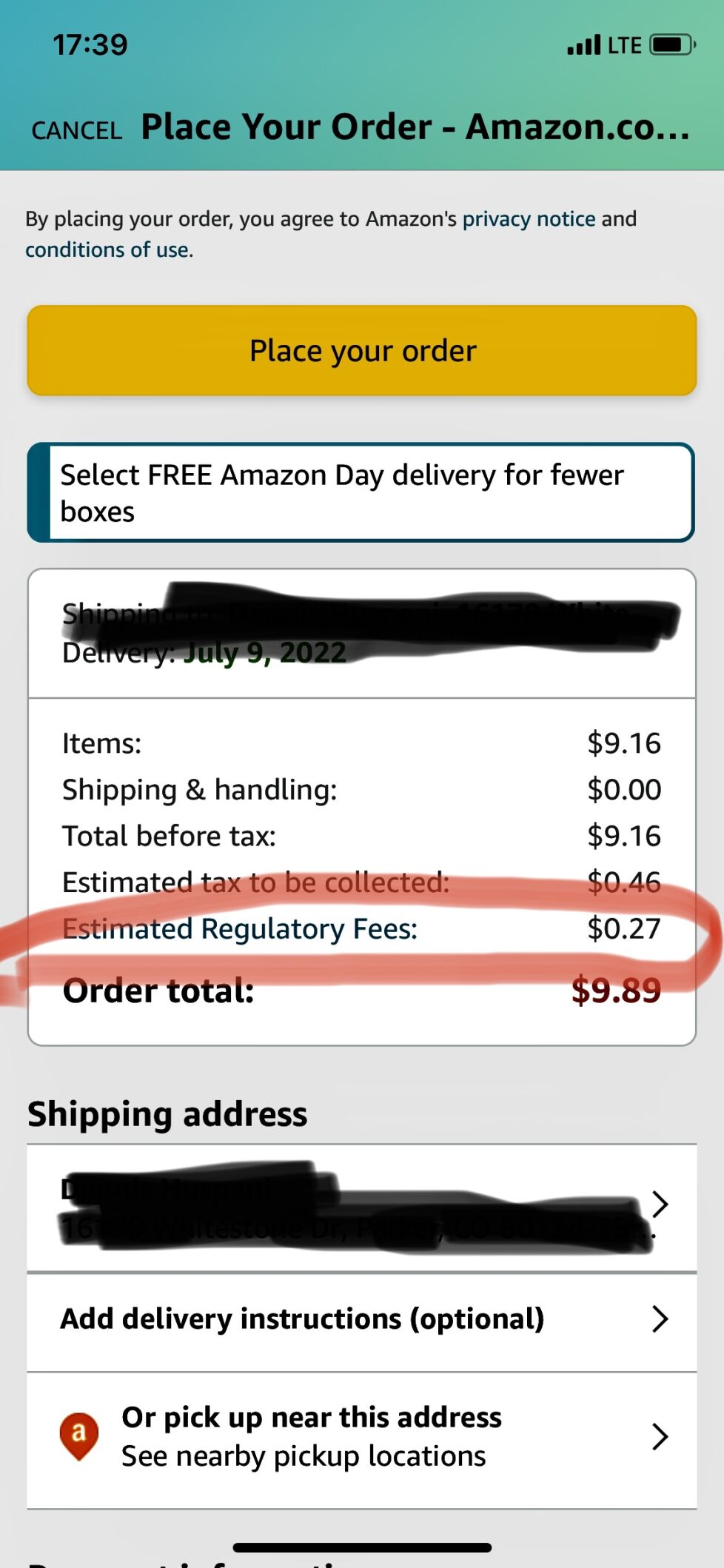

Confusion Swirls As Colorado Imposes New Retail Delivery Fee Catching Businesses By Surprise Business Denvergazette Com

Colorado Sells 2 2 Billion In Marijuana Last Year Setting A New Record

Collateral Damage Aurora Bars And Restaurants Among The Casualties In The Fight Against The Pandemic Sentinel Colorado

Colorado Sales Tax Rate Rates Calculator Avalara