fidelity california tax free bond fund

Fidelity also offers tax-free municipal bond funds that focus on states like California New York and Massachusetts. FCSTX Mutual Fund Guide Performance Holdings Expenses Fees Distributions and More.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

Best Fidelity Funds To Keep Taxes Low

Its portfolio consists of municipal.

. Fidelity calculates and reports the portion of tax-exempt interest dividend income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal. The Fund seeks a high level of current income exempt from federal and California personal income taxes. 6 rows Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX.

The minimum initial investment is 25000. Fidelity Tax-Free Bond has found its stride. The investment seeks a high level of current income exempt from federal and California personal income taxes.

After taxes on distributions and sale of fund shares. The expense ratio is 025. FIDELITY CALIFORNIA LIMITED TERM TAX-FREE BOND FUND- Performance charts including intraday historical charts and prices and keydata.

8 rows Find the latest Fidelity California Limited Term Tax-Free Bond Fund FCSTX stock quote. N FidelityCalifornia Limited Term Tax-Free Bond Fund 11621 n Muni Single State Short 11318 The performance data featured represents past performance which is no guarantee. Ad Research a Variety of Municipal Bond Funds Available from Fidelity.

6 rows Fidelity California Limited Term Tax-Free Bond Fund. Analyze the Fund Fidelity California Municipal Income Fund having Symbol FCTFX for type mutual-funds and perform research on other mutual funds. FCSTX The California Limited Term Tax-Free Bond Fund fund symbol FCSTX is an exchange traded fund ETF within the.

Find the top rated Muni California Long mutual funds. Strategy Normally investing at least 80 of assets in investment-grade. Compare reviews and ratings on Financial mutual funds from Morningstar SP and others to help find the best Financial mutual fund for.

The fund normally invests at least 80 of assets in investment-grade municipal. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. Fund Overview Objective Seeks a high level of current income exempt from federal and California personal income taxes.

Under normal market conditions the Fund will invest at least 80 of assets in. Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the. Fidelity California Limited Term Tax-Free Bond Fund-363.

Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds. Fidelity - California Limited Term Tax-Free Bond Fund Symbol. As of January 21 2022 the fund has assets totaling almost 472 billion invested in 1363 different holdings.

Fidelity Money Market Funds How To Choose The Best One

Cadnx Columbia Strategic Municipal Income Fund Columbia Threadneedle Investments Us

How To Buy Municipal Bonds Ally

5 Best Index Funds With Low Expense Ratios Nextadvisor With Time

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

Nuveen Municipal Value Fund Inc Stock Certificate Stock Certificates Common Stock All My People

What Is An Index Fund Forbes Advisor

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

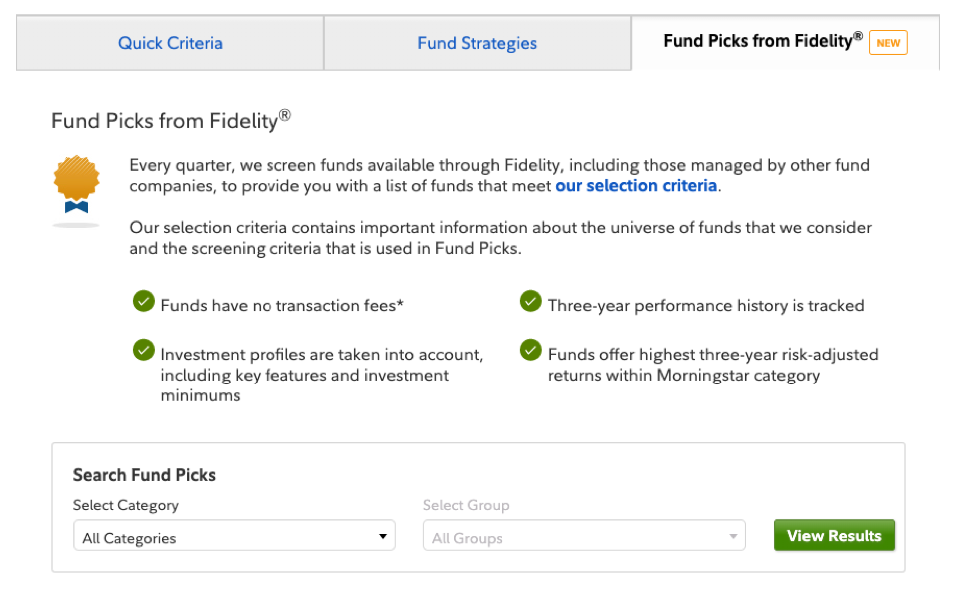

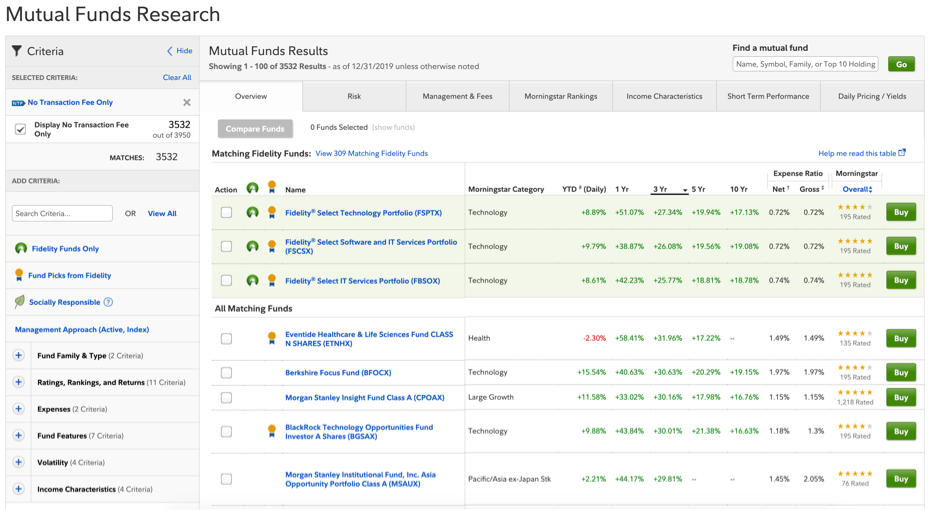

Stock Screeners Fund Comparison Tools From Fidelity

How To Invest In Index Funds A Beginner S Guide Nextadvisor With Time

Stock Screeners Fund Comparison Tools From Fidelity

10 Best Intermediate Municipal Bond Funds For The Long Term Mutual Funds Us News

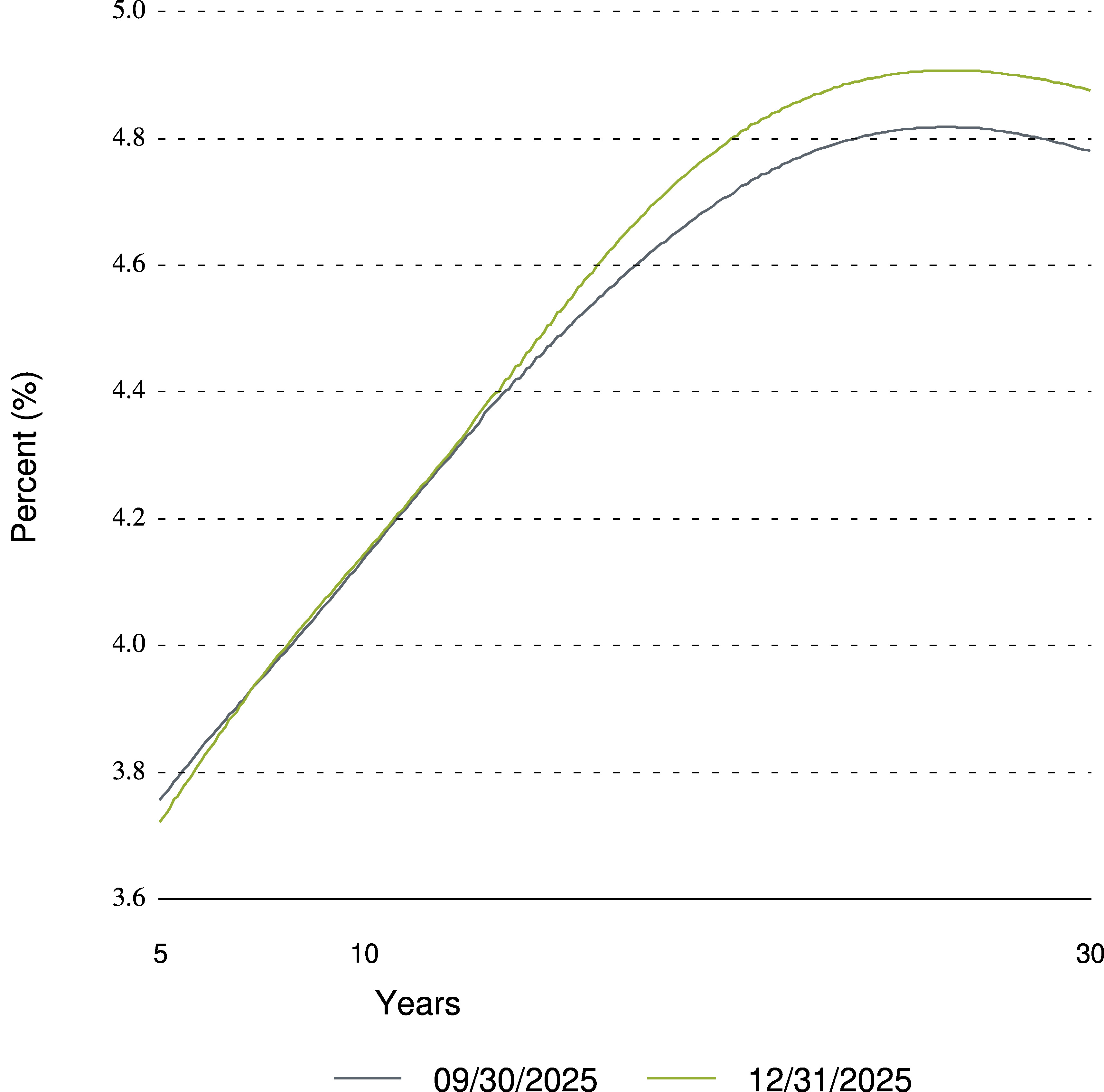

Market Watch 2021 The Bond Market Fidelity

Ftbfx Fidelity Total Bond Fund Fidelity Investments

Standard Oil Company Bond Stock Certificate Exxon 14 99 Standard Oil Stock Certificates Oil Company

/GettyImages-463030071-5722c4033df78c56405f298e.jpg)